It’s clear that consumers are shifting toward a world in which they rely less on paper money, and businesses are already following suit. The next decade of commerce may look nearly unrecognizable when compared to commerce of the past. Visa recently released the findings of a survey that found that 82% of SMBs will accept digital payment processing options this year. Nearly half (46%) of consumers also expect to use digital payments more often. Only 4% said they would use digital payments less.

Processing Online Payment Findings

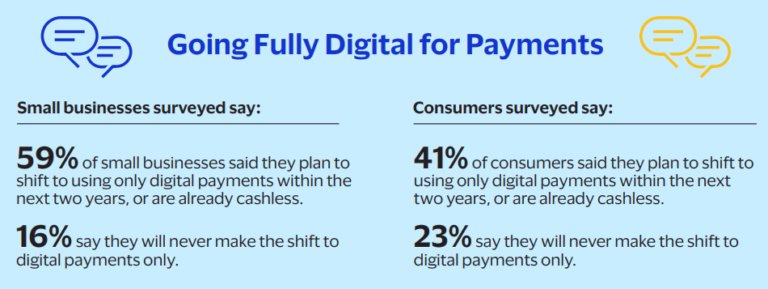

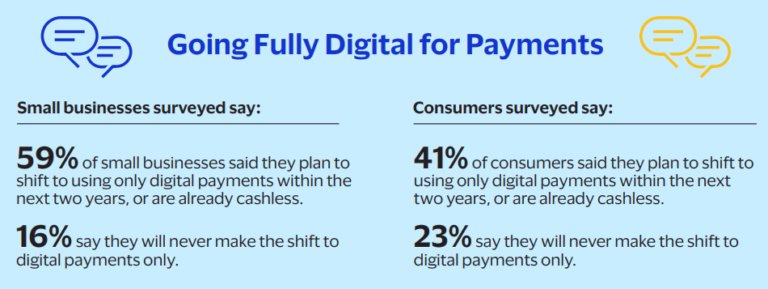

Small businesses (59%) said they plan to go completely digital with payments over the next two years, or, they’re already doing a cashless operation. Only 16% said they would never make the shift to digital-only payments.

The survey found that 64% of respondents anticipate being able to make such a shift within 10 years. Of the SMBs polled, 18% are cashless already.

Image via Visa

Visa’s head of merchant sales, Jeni Mundy, commented, “Payments are no longer about simply completing a sale. It’s about creating a simple and secure experience that reflects one’s brand across channels and provides utility to both the business and its customer.” Mundy noted that businesses forced to adopt digital payments and infrastructure due to COVID-19 lockdowns now held a competitive advantage.

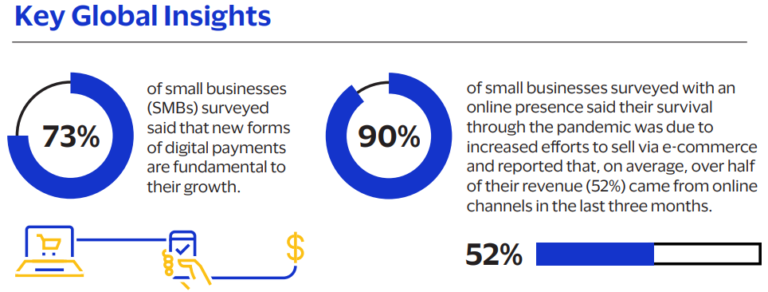

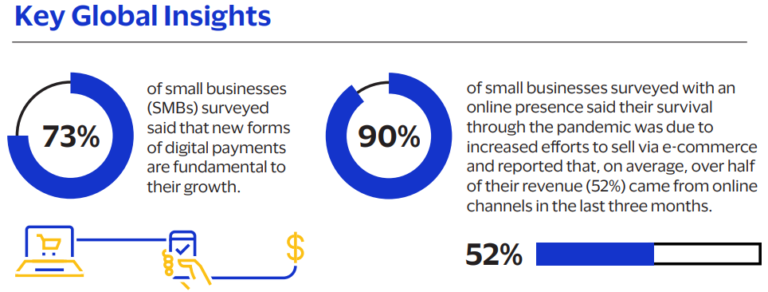

Eighty-two percent of SMBs said they would start to use digital options this year, while 73% expressed that their growth was highly dependent on adapting to new payment methods. Twenty-four percent even said they intend to accept cryptocurrencies like Bitcoin.

Image via Visa

On the consumer side of things, over half of the respondents said they expect to use digital payments exclusively in the next ten years, with 25% saying this would happen in the next two years. Sixteen percent reported already using digital-only payments. Forty-seven percent said the top benefit is easier online shopping, followed by decreased likelihood of theft (38%), and ease of use (37%).

Another finding of note is that 41% of consumers surveyed said they have decided against a physical store purchase because the store did not accept online payments. Visa also noted this was particular among younger customers.

Alpine Bank can help process remote payments for your business. Learn more about our AlpineRemote check cashing service.

About This Author

Alpine Bank Staff

Alpine Bank is an independent, employee-owned organization with headquarters in Glenwood Springs and banking offices across Colorado’s Western Slope, mountains and Front Range.

More about Alpine Bank Staff