Residents and descendants of Front Range “redlined” neighborhoods may qualify

The availability of a mortgage loan to purchase a home is something many of us take for granted. After all, these days the process can be as simple as getting in touch with a mortgage lender and submitting an application with a handful of financial information. However, historical injustices haven’t made the process this easy for some.

In the past, for individuals attempting to purchase a home in a neighborhood that has historically been associated with lower income households or minority residents, the availability of mortgage loans may have been limited.

This is the result of a practice called “redlining” which is defined as the denial of a credit-worthy mortgage application on the basis of the neighborhood in which the property is located.

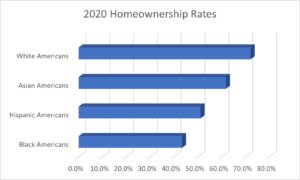

Thankfully, this practice is now illegal and monitored closely by regulatory agencies. However, it’s been a contributing factor to a longstanding racial disparity in homeownership rates within the United States.

The chart below* illustrates this reality:

Now that we’ve established the existence of a racial disparity in homeownership rates, let’s explore the financial impacts.

Home values may ebb and flow in the short term. But when we consider their valuations from a long-term perspective, we see they tend to appreciate over time. The average value of a single-family property in January 1992 was $119,500. Fast-forward 30 years to end-of-year 2021, and the average value jumped to $423,600.**

This means that over the 30-year period, the average single-family home appreciated at an annual rate of roughly 4.3%. This also means that a borrower who was subjected to redlining in 1992 would have missed the opportunity to gain 30 years of appreciation, leaving them with a net worth that is approximately $304,000 lower than it would have been otherwise.

There are some additional factors that could be considered here, such as the average savings rate of an individual, the interest expense associated with their loan, and more. However, for our purposes this example paints a clear picture of how redlining caused detrimental financial impacts for victims of the practice.

Fortunately, there’s a current focus on righting the wrongs of the past within the mortgage industry. Joining in this effort, Alpine Bank is offering a Social Equity Down-Payment Assistance Program in partnership with MetroDPA. This program provides down payment assistance in the amount of $15,000-$25,000 for residents, and descendants of residents, who lived in a redlined neighborhood along Colorado’s Front Range between 1938 to 2000.

Considering that the minimum down payment on a conventional loan is just 3% in many cases, this program could allow a homebuyer to purchase a home without putting down any money at all.

This program cannot correct the injustices caused by redlining; however, it does provide an opportunity for those impacted to begin their path toward building generational wealth through homeownership.

Your local Alpine Bank mortgage loan originator can provide additional information and answer questions. Please note that if you are unable to qualify for the social equity program, Alpine Bank additional down payment assistance programs available.

Sources

*Homeownership rates by race

https://www.nar.realtor/blogs/economists-outlook/racial-disparities-in-homeownership-rates

**Historical appreciation rates