Though slowing, survey shows inflation remains a top challenge for small businesses

According to the National Federation of Independent Business (NFIB) Small Business Optimism Index, inflation has eased slightly for small businesses, but it remains the top business problem owners are facing.

The NFIB’s report found that the net percent of owners raising average selling prices decreased one point month-over-month to a net 42% (seasonally adjusted). This was the lowest since May 2021. Unadjusted, 10% reported lower average selling prices, while 51% reported higher average prices. Price increases were found to be most prevalent in construction, retail, wholesale and transportation.

NFIB Chief Economist Bill Dunkelberg commented on survey respondents’ sentiments. “While inflation is starting to ease for small businesses, owners remain cynical about future business conditions,” he said. “Owners have a negative outlook on the small business economy but continue to try to fill open positions and return to a full staff to improve productivity.”

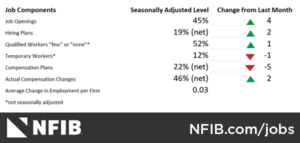

Forty-five percent of business owners reported job openings that were hard to fill. Job openings where up four points month-over-month. According to the NFIB, this percentage is very high compared to historical data.

The report reiterated findings from the NFIB’s jobs report, such as 57% of owners reporting hiring or trying to hire. Of those hiring/trying to hire, 91% reported few or no qualified applicants for the positions they were trying to fill.

The net percentage of business owners who said they expect real sales to be higher dropped four points month-over-month, to a net negative 14%.

Fifty-nine percent of owners reported capital outlays in the previous six months. This number was up four points. Of those making expenditures, the report found, 42% of owners reported spending on new equipment, 24% acquired vehicles and 11% spent money on new fixtures and furniture. Fourteen percent improved or expanded facilities, while 8% acquired new buildings or land for expansion. Twenty-one percent said they plan capital outlays in the coming months.

More businesses reported inventory increases. According to the NFIB, accumulation is starting now that supply problems are being resolved and consumer spending has eased.

Seventeen percent reported increases in stocks, and 17% reported reductions. Twenty-five percent reported that supply chain disruptions have had a significant impact on their business. Shortages were most frequently reported in wholesale (14%), retail (13%), manufacturing (11%) and finance (10%).

Forty-six percent of business owners reported raising compensation. Twenty-two percent reported they plan to raise compensation in the coming three months, a metric that’s down five points from the previous month. Ten percent of owners cited labor costs as their top business problem and 24% said that labor quality was their top business problem.

More businesses reported positive profit trends than the previous month. Among those reporting lower profits, 27% blamed weaker sales, while 26% pointed to the rising cost of materials. Fifteen percent cited seasonal change and 11% cited labor costs. For those reporting higher profits, 53% cited sales volumes, 23% cited usual seasonal change and 11% cited higher prices.